How to Identify and Avoid Hidden Fees in Health Insurance Plans

Health insurance can be tricky to understand. Some costs may be hidden in your plan, making it more expensive than expected. Knowing how to spot these hidden fees is key to saving money and avoiding surprises. Let’s explore how to identify these fees and keep your health insurance affordable.

Understand Your Premium

The premium is what you pay every month to keep your health insurance active. While it may seem like the main cost, it’s not the only one. Make sure you know what your premium covers and what it doesn’t. Some health insurance 2025 plans offer low premiums but make up for it with higher out-of-pocket costs.

Watch Out for Deductibles

The deductible is the amount you must pay before your insurance starts covering costs. For example, if your deductible is $2,000, you will need to spend that much before the insurance helps. Be sure to check if your plan’s deductible fits your budget. Plans with low premiums often have higher deductibles.

Copayments and Coinsurance

Copayments, or copays, are fixed amounts you pay when visiting a doctor or getting a prescription. Coinsurance is the percentage of the medical cost that you must pay after meeting your deductible. Some health insurance plans have higher copays or coinsurance, which can quickly add up. Always ask about these fees before choosing a plan.

Out-of-Network Fees

Most health insurance plans have a network of doctors and hospitals. If you visit a doctor outside this network, your costs can skyrocket. Out-of-network visits often lead to extra fees or higher charges. Always check if your preferred doctors and hospitals are in-network to avoid unexpected expenses.

Prescription Costs

The cost of prescription drugs can vary between plans. Some health insurance plans cover a wide range of medications, while others only cover basic drugs. If you take regular medications, make sure your plan covers them at an affordable rate. Look out for any caps or limits on prescription drug coverage.

Look for Annual Limits

Some health insurance plans have annual or lifetime limits on how much they will cover. Once you reach that limit, you will have to pay for medical expenses yourself. Always ask if your plan has any limits on coverage. Avoid plans with low limits, especially if you expect ongoing medical needs.

Read Also: Thomas Wilson Brown Net Worth: His Financial Success

Additional Services and Fees

Some plans charge extra for services like mental health care, physical therapy, or specialist visits. These fees might not be obvious at first. Make sure to review your plan’s details and see what services are included. If certain services are important to you, confirm they are covered without hidden fees.

Avoid Short-Term Plans

Short-term health insurance plans often seem cheaper but can come with many hidden fees. They may not cover essential services, like maternity care or emergency services. These plans might also charge high fees for routine care. Stick to comprehensive health insurance plans that offer better protection.

Ask Questions Before Enrolling

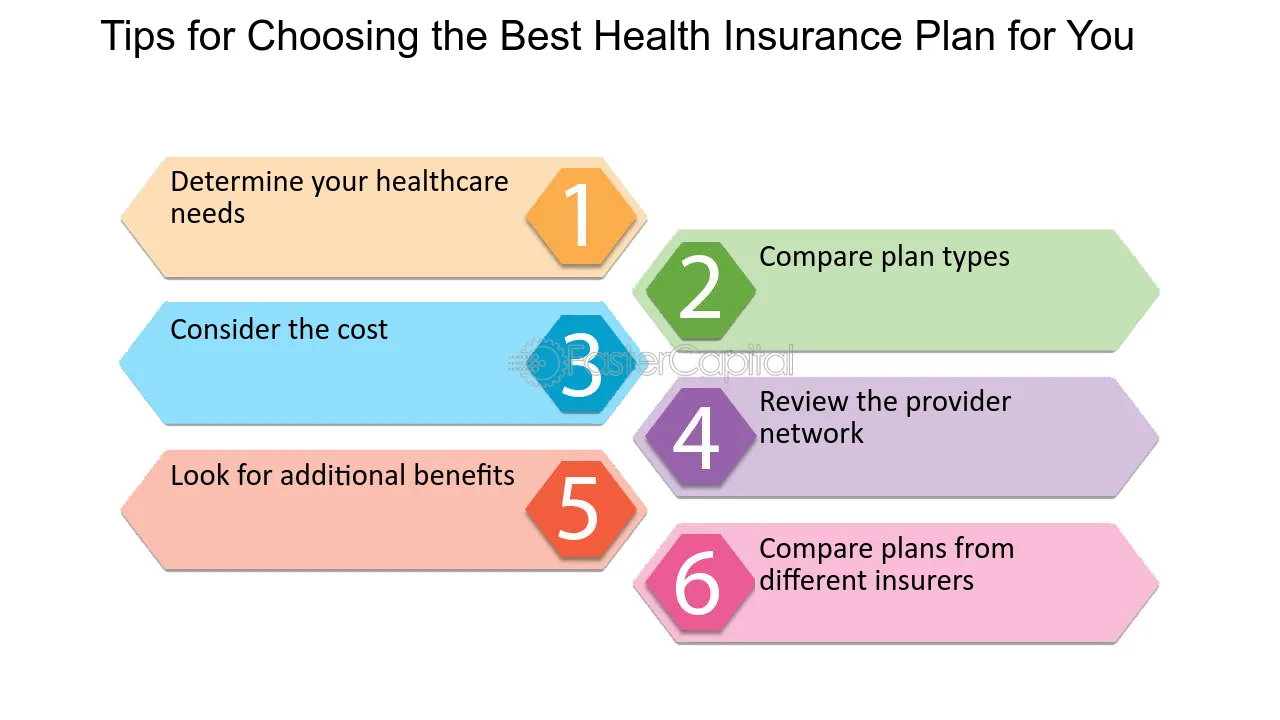

Before you sign up for a health insurance plan, ask questions. Find out exactly what is and isn’t covered. Ask about out-of-pocket costs, deductibles, and copays. Be clear on any additional fees. If something seems unclear, ask for a detailed breakdown. The more you know upfront, the less likely you’ll be surprised by hidden costs later.

Review Your Plan Each Year

Health insurance plans can change from year to year. Premiums may rise, or new fees could be added. It’s important to review your plan at the start of each year to see if anything has changed. You may want to switch to a better plan if your current one becomes too costly.

Choosing the right health insurance plan takes careful research. Hidden fees can quickly add up, but by knowing what to look for, you can avoid them. Keep your plan affordable by being informed and asking the right questions. Make sure your health insurance in 2025 meets your needs without surprising you with extra costs.